Digitizing Trading: Exploring the Power of Copytrade Bots

Estimated reading time: 7 minutes

Key Takeaways

- **Copytrade bots** use automated technology to replicate successful traders’ strategies.

- These systems improve accessibility to trading for beginners by removing the knowledge barrier.

- They offer psychological advantages by reducing emotional trading decisions.

- Copy trading can enhance learning opportunities while mitigating risks.

Table of contents

- Introduction: Embracing the Automated Trading Revolution

- Demystifying Copytrade Bots

- Getting to Grips with Copy Trading Automation

- Unpacking Automated Copy Trading Systems

- Setup and Use of Copytrade Bots – Simplified

- Advantages of Employing Automated Copy Trading Systems

- Identifying the Ideal Copytrade Bot – Things to Keep in Mind

- Step-by-step Guide to Starting Trading Automation for Beginners

- Ensuring Safety and Managing Risk in Automated Copy Trading

- Anticipating Future Trends in Automated Copy Trading

- Conclusion: Making Trading Platforms Accessible to All

- Frequently Asked Questions

Introduction: Embracing the Automated Trading Revolution

In the ever-evolving vista of technology, financial markets haven’t been left behind. Automation is substantially minimizing the knowledge barrier in trading, equipping beginners with a powerful tool—copytrade bots. The intricate functioning of these bots lies in their ability to replicate expert trading strategies, optimizing the user’s profit-making capabilities and considerably ridding the emotional biases associated with trading decisions.

The crux of this article lies in its detailed exploration of copytrade bots; their functioning, their benefits, and the important factors to keep in mind when commencing on this fascinating investment path. If you’re a novice in trading, looking to delve into prospective financial markets, this is your go-to guide.

Demystifying Copytrade Bots

The critical component of copytrade bots is their sophistication as software programs that copy the trades executed by professional traders, in real-time. This fascinating development in trade technology ensures that market rookies can glean successful strategies, leading to informed decisions and profitable results.

The advantage of using copytrade bots isn’t limited to efficiency; they also facilitate users in maintaining a psychologically detached approach when the market undergoes fluctuations—allowing for a consistent strategy and promising results.

Getting to Grips with Copy Trading Automation

Copy trading automation systems make the financial market more accessible by allowing less experienced investors to duplicate expert traders’ decisions—minus the manual intervention.

Few of the advantages of copy trading automation include:

- *Accessibility*: Even novices get to experience market strategies without extensive prior knowledge.

- *Professional Expertise*: Informed trading decisions can be made by duplicating expert traders’ trades.

- *Risk Mitigation*: By investing across multiple trades, risk is spread—enhancing return potential.

- *Trading Efficiency*: Quick trades execution via automated systems curb chances of missing potential opportunities.

The above benefits equip beginners with the tools necessary to thrive and grow in the financial market while learning about different strategies used by experienced traders.

Unpacking Automated Copy Trading Systems

To understand exactly how automated copy trading systems operate, it becomes vital to understand their four main components – *Trade Copier Engines, User Interfaces, Risk Management Tools, and Platform Integration*.

Easy to access and navigate interfaces, precise trade execution, customized risk tolerance setting, and compatibility with popular trading platforms make these systems a powerful tool for both beginners and pros in the trading industry.

Setup and Use of Copytrade Bots – Simplified

Copytrade bots work in a singularly unique manner, benefiting users the way human manual intervention really can’t. They accomplish this by tracking buy and sell signals of experienced traders, replicating them in real-time, executing buy and sell orders immediately, and applying risk management parameters to protect users. This consolidated process eliminates emotional decision-making and promotes consistent strategies that yield good results.

Advantages of Employing Automated Copy Trading Systems

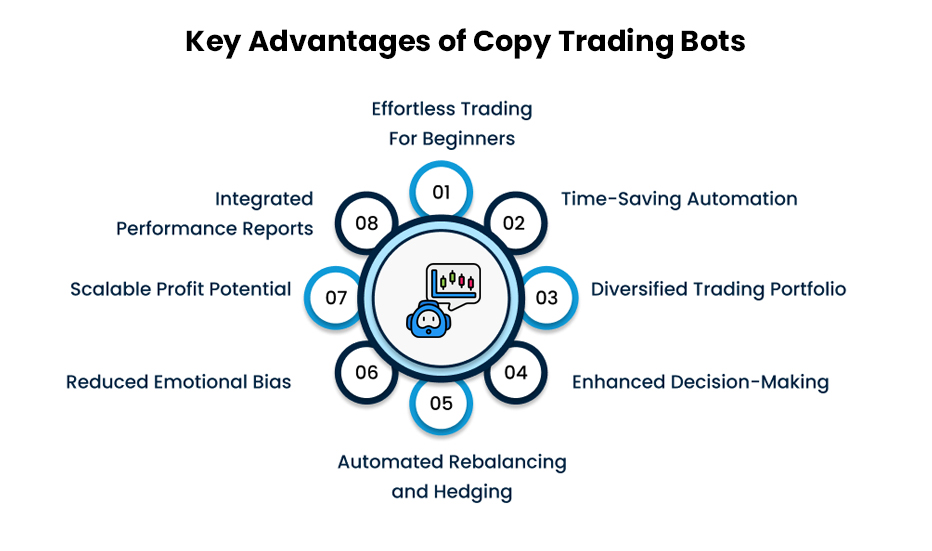

Opting for automated copy trading systems gives rise to numerous benefits for beginners, the most notable ones being:

- *Superior Efficiency*: Continuous trade execution without requiring constant monitoring.

- *Greater Accuracy*: Lower human error chances and reduced emotional decision-making.

- *Time-Saving*: Massively reduces time spent on analyzing market movements and manual input.

- *Fruitful Learning Opportunities*: Helps beginners learn from experienced traders’ strategies.

- *Effective Diversification*: Ability to spread investments across different assets and trading styles.

The above-mentioned benefits provide beginners the unique opportunity to learn from and interact with financial markets.

Identifying the Ideal Copytrade Bot – Things to Keep in Mind

When choosing a copytrade bot, consider features such as easy navigation, precise trade execution, customizable parameters, inherent risk management tools, compatibility with popular trading platforms, and strong customer support to ensure profitable trading experiences.

Step-by-step Guide to Starting Trading Automation for Beginners

To start with trading automation, initially create an account on a reputable platform offering copy trading capabilities, fund your account modestly, select traders based on their performance, risk profile, and trading strategies, set risk management parameters based on your comfort level, and regularly monitor your investment performances.

Ensuring Safety and Managing Risk in Automated Copy Trading

In the automated copy trading world, understanding safety procedures and managing risk is a must. Diversify your investments, set trading limits, monitor performance, and start with smaller investments to stay safe while trading.

Anticipating Future Trends in Automated Copy Trading

With technology outdoing itself every passing day, automated copy trading strikes as the future of financial markets, with elements such as AI Integration, Platform Interoperability, Enhanced Customization, and Expansion into New Assets.

Conclusion: Making Trading Platforms Accessible to All

The newly democratized state of trading—made possible by copytrade bots—is a novel concept, bringing expert-grade strategies to a broader audience than ever before. As with any investment, those ready to dive in must be aware of potential risks, enforce robust risk management procedures, and pursue an ongoing commitment to learning the financial market’s nuances.

Begin your journey of informed investment and confident trading with Duplitrade, Cryptohopper, and Binance, and discover the many benefits of automated trading.

With the combination of astute investment practices and cutting-edge technology, trading holds a promising future for beginners and experienced traders alike.

Frequently Asked Questions

Q1: What is a copytrade bot?

A copytrade bot is an automated tool that replicates the trading strategies of experienced traders in real-time to help beginners invest successfully.

Q2: How safe are copytrade bots?

While copytrade bots can effectively manage risk, it is important to choose a reputable platform and use risk management strategies.

Q3: Can copytrade bots be used for all financial markets?

Many copytrade bots provide access to various financial markets, including Forex, cryptocurrencies, and stocks, depending on the platform.